Get Support: Money

This section includes

- Help with benefits

- Help with Health costs

- Help with Cost of Living

- Help with emergency needs

- Finding affordable Internet

Here is a summary of a few ways in which low-income households can reduce their outgoings. To qualify for reduced tariffs, it is often necessary to provide a summary of your personal budget outlining your incoming payments and outgoing expenses. A sample budget plan can be found here to help you Budget-Worksheet.pdf (capuk.org)

- Help with benefits

- Help with Health costs

- Help with Cost of Living

- Help with emergency needs

- Finding affordable Internet

Here is a summary of a few ways in which low-income households can reduce their outgoings. To qualify for reduced tariffs, it is often necessary to provide a summary of your personal budget outlining your incoming payments and outgoing expenses. A sample budget plan can be found here to help you Budget-Worksheet.pdf (capuk.org)

Benefits

If you’re struggling with the cost of living, you should check if you can claim benefits or increase your current benefits.

• You can use the Entitledto benefits calculator for a detailed overview of what you might get. Entitledto’s calculator is particularly useful if:

o you’re already claiming benefits

o you’re sick or disabled Use the Entitledto benefits calculator.

• You can also use the Turn2us benefits calculator for a quick idea of what benefits and other financial help you might be eligible for.

Use the Turn2us benefits calculator.

When and how do I apply for Universal Credit (UC)?

UC is the primary financial help you receive so you should apply straight away. Go to: www.gov.uk/universal-credit/how-to-claim

If you don't have a bank account:

If a claimant does not have a bank account at the time they are making a new claim to Universal Credit, the following steps must be followed: during the new claim add 6 zeros (000000) for the sort code add 8 zeros (00000000) for the bank account number this will need to be done 4 times to progress the claim. If there is no option to say they don't have a bank account they will have to follow the above steps

See also Citizens Advice Bureau - What is Universal Credit

Can I get a Universal Credit advance?

As long as they have a live UC claim, as well as a National Insurance Number, job centre can issue a full new claim advance. Weybridge Jobcentre covers over 90% of Elmbridge postcodes (in terms of UC claims) – and covers the following: KT7, KT8, KT10, KT11, KT12, KT13, KT14 7, KT14 9, KT15, KT16, and KT22 0. Postcodes beginning KT6 would be covered by Kingston Job Centre.

When and how can I cancel or change a Universal Credit appointment?

You can change or cancel a Universal Credit appointment, following DWP guidelines, by signing into your Universal Credit Account or by phoning: 0800 169 0190

If you are on jobseeker’s allowance, you must prioritise your jobseeker’s activities, such as: attending interviews, job fairs, training courses, etc... If any of those activities are clashing with your UC signing in appointments with a coach, you can re-arrange your UC appointment as described above. Changing your UC appointment in advance, following DWP guidelines, provided you have a valid reason, will not affect your benefits.

Universal Credit frequently asked questions

What are the monthly standard allowances?

If you’re single and under 25: £265.31

If you’re single and 25 or over: £334.91

If you live with your partner and you’re both under 25: £416.45 (for you both)

If you live with your partner and either of you are 25 or over: £525.72 (for you both)

For your first child: £290.00 (born before 6 April 2017), £244.58 (born on or after 6 April 2017)

For your second child and any other eligible children: £244.58 per child

How Your Earnings and Hours Affect Your Payments?

Your Universal Credit payment will reduce as you earn more. For every £1 you or your partner earns your payment goes down by 55p. There are different rules if you’re self-employed. There’s no limit to how many hours you can work. Most employers will report your earnings for you.

You can earn a certain amount before your Universal Credit is reduced if you or your partner are either responsible for a child or are living with a disability or health condition that affects your ability to work. This is called a ‘work allowance’.

Monthly work allowance

You get help with housing costs: £344

You do not get help with housing costs: £573

Housing allowance see housing page

Housing Assistance

Reporting Change of Address and Housing Costs?

Report changes through your universal credit account. This is on the Home tab then Change of circumstances then Where you live and what it costs. The DWP will then send you a to-do asking for proof of the tenancy and proof of address. The most you can receive is the local housing allowance (LHA) rate for your household. This can be found at lha-direct.voa.gov.uk. Once you start paying rent a housing element will be included in your universal credit and will be paid monthly in arrears. Universal credit payment dates will not change.

Rent

• Discretionary housing payments can be available from Elmbridge Borough Council to provide financial help with rent or housing costs. You can claim if:

The payments are short-term to help pay rent and give you time to improve your circumstances. They can be awarded as a one-off payment or a series of payments.

Applications can be made online via this link: Discretionary Housing Payment (DHP) | Elmbridge Borough Council

• The Surrey Crisis Fund is a discretionary fund run by Surrey County Council. It provides financial help to Surrey residents who have nowhere else to turn in an emergency or following a disaster. It also can provide assistance to set up a home in the community where no other funds or resources are available. Applications can be made online or via your local Citizens Advice Bureau Surrey Crisis Fund - Surrey County Council (surreycc.gov.uk)

Council Tax

Elmbridge Borough Council will consider offering a reduction in council tax or alternative payment plan to those receiving Universal credit. Eligibility can be found their website. Discounts are also offered to those with diagnosed mental health conditions, disabilities and also to full time students.

Council Tax Support | Elmbridge Borough Council

Help with Energy and other costs

Sometimes you can claim extra money for particularly cold weather, or get help with insulating your house to keep it warmer, or your electricity company will discount you if you are on certain benefits..

More info here - Government Cost Of Living Support

Utilities

Most utility companies offer ‘social tariffs’ specifically for those in low-income groups. These normally must be applied for online.

Water:

• Apply for the low income fixed tariff - Affinity Water

• Financial support | Account and billing | Help | Thames Water

• Help paying your water bill | South East Water

Energy – Gas & Electricity:

Communications

• Broadband and phone tariffs - Social tariffs are cheaper broadband and phone packages for people claiming Universal Credit, Pension Credit and some other benefits. Some providers call them ‘essential’ or ‘basic’ broadband.

Social tariffs: Cheaper broadband and phone packages - Ofcom

Cost of Living Payments

Households on certain means-tested benefits will get £900 in 2023/24 – the final instalment will be paid in February 2024. It'll be paid in three instalments, with the first two already paid: £301 – paid between 25 April and 17 May; £300 – paid between 31 October and 19 November 2023; £299 – to be paid between 6 and 22 February 2024.

To qualify for the final payment, you needed to be claiming one of the following benefits (or later found to be entitled to the benefit) between 13 November and 12 December 2023 (for Universal Credit, you need to have an assessment period that ended between those dates)

If you didn't receive the first or second payment, but think you're entitled, the Government has launched a webpage to report a missing payment.

Children / Childcare

Childcare costs

You can claim back up to 85% of your childcare costs if you’re working. If you live with your partner both of you need to be working, unless one of you is unable to work due to a disability or health condition. The childcare needs to be from an Ofsted registered provider. You can get help paying for childcare including nurseries, childminders, breakfast clubs, after school care and holiday clubs.

The most you can get each month is:

• £646.35 for one child

• £1108.04 for 2 or more children

You need to pay your childcare costs up front and claim the money back as part of your payment. You can get support to help you pay your childcare costs up front. Talk to your work coach after you’ve made your claim.

Finding Childcare and funded hours.

You can find out about your options of funded childcare at www.childcarechoices.gov.uk/

The easiest place to find registered childcare is at familyinformationdirectory.surreycc.gov.uk/ then click on the Childcare finder or at www.childcare.co.uk

• Free School Meals – all pupils in Reception, Years 1 & 2 in state funded schools are entitled

to free school meals. From Year 3, pupils may be entitled to free school meals if their parents receive qualifying benefits. Contact the school to make an application.

• Tax-free childcare - The Government offer up to £2,000 a year of tax-free childcare to help lower costs. Visit Get tax free childcare (GOV.UK) to see if you are eligible.

▪ School uniforms – If you are struggling to pay for school uniforms, here are a number of suggestions to reduce this cost:

The following charities and organisations below may be able to help with the cost of school uniforms:

• Funded early education for Two-year-olds (FEET) can start at the beginning of the next Department of Education period following their second birthday. Children are entitled to a maximum of 570 hours per year. These will usually be offered as 15 hours each week for 38 weeks a year. Children are eligible, if your family receives Universal Credit, and your household income is £15,400 a year or less after tax, not including benefit payments OR Income Support, Income-based Jobseeker's Allowance (JSA) and Employment and Support Allowance (ESA). You can apply online through the funded childcare parent portal or email [email protected] for a paper application form.

• Funded early education and childcare for 3 and 4 year olds - all three and four-year-olds are entitled to up to 15 hours of funded early education and childcare a week for up to 38 weeks a year. This is to give children the opportunity to take part in planned learning activities and help prepare them for school through the early learning goals set out in the Early Years Foundation Stage. This is a universal offer and is available to all children regardless of their family circumstances.

• You can get 30 hours free childcare at the same time as claiming Universal Credit, tax credits, childcare vouchers, or Tax-Free Childcare. The funded hours will be made available to families where both parents (or the sole parent in a lone parent family):

Housekeeping (Food, Toiletries, Nappies, Clothing, etc):

• The Bridge The Bridge — Walton Charity working in the heart of the local community - Located in Walton, The Bridge is a community hub supporting families across Elmbridge who are struggling with the rising cost of living. It’s open on Tuesdays, Wednesdays and Thursdays for families who have been referred. Please speak to your child’s school, your GP or Elmbridge CAN for a referral. They offer a shop-without-a-till where families can pick-up fresh, frozen and cupboard food and household supplies at no cost, freeing up money for other family essentials like utility bills and school uniform. Families can also access specialist support and advice from Citizens Advice, Elmbridge Family Centre, Surrey Lifelong Learning and other local organisations. Regular wellbeing activities, like yoga, are available too.

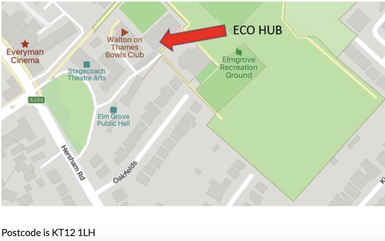

• Elmbridge Eco Hub - Based in Walton, the hub provides access to a multi functional, safe space where they can reduce waste and access many beneficial initiatives such as the Library of Things, Community Fridge, Refill Shop, Skill Share, Repair Cafe, Small item recycling, Community Garden, Seed Bank, Jigsaw swap, Book Swap. No referral is needed.

Remember to take shopping bags if visiting to collect free food from the community fridge.

• Foodbanks How to get help | East Elmbridge Foodbank Walton & Hersham Foodbank | Helping Local People in Crisis Before you come along to a food bank centre to get food, you need a voucher. Vouchers can issued from the citizens advice bureau’s, schools, local charities.

• Elmbridge CAN Home (elmbridgecan.org.uk) aim to support families settle within our community. We can offer referrals and support in accessing local support services such as food banks; help source furniture for new homes; offer small emergency grants.

TV Licence

Do you need one? A TV Licence covers you to:

Debt Support / Advice

o CAB Esher & District, Harry Fletcher House, High Street, Esher KT10 9SD · Tel: 01372 464770 Website: eshercab.org.uk

Please Note: If you are struggling to pay your bills, it is always best to contact your provider straight away and explain. They may be able to put you on one of the reduced payment plan or social tariffs mentioned above. Never ignore bills, this can lead to penalty payments and increased debt.

For up to date information on the best deals for utilities, credit cards, broadband, mobile phone tariffs and more, take a look at: Money Saving Expert: Energy Help, Credit Cards, Flight Delays, Shopping and more

Can I get help with my NHS health costs if I'm a refugee or Asylum Seeker? If you receive Asylum Support from UKVI (UK Visas and Immigration), you’re entitled to a HC2 certificate, free NHS prescriptions, free NHS dental treatment, free NHS sight tests, help towards the cost of glasses or contact lenses, free NHS wigs and fabric supports, help towards travel costs to receive NHS treatment Read more

If you are in receipt of universal credit and your take-home pay per month is up to £435 or up to £935 if you are responsible for a child or have limited capability for work. You are likely to be asked to show your last month payment statement. Further information is available at: www.nhs.uk/nhs-services/help-with-health-costs/

ENIC – Statement of Comparability

ENIC is a service available if you need to evidence the level of your overseas qualification for employment, study, professional registration, or another reason. There website is https://www.enic.org.uk/Qualifications. If you need this is support for application for employment, please discuss this with your work coach.

Flexible Support Fund

Your work coach has funding to support you in removing barrier to finding or start work – this could be internet access, travel cost to interviews or to start work, appropriate clothing, upfront childcare cost. If there is a Barrier to you starting work, please discuss this with your Work Coach.

Benefit Calculator – Entitled to

This will give you an estimate of the benefits you could get and how your benefits will be affected if you start work or increase your hours. The website is: www.entitledto.co.uk/benefits-calculator

When and how should I apply for Pension Credits

Go to Pension Credit: Overview - GOV.UK (www.gov.uk)

• You can use the Entitledto benefits calculator for a detailed overview of what you might get. Entitledto’s calculator is particularly useful if:

o you’re already claiming benefits

o you’re sick or disabled Use the Entitledto benefits calculator.

• You can also use the Turn2us benefits calculator for a quick idea of what benefits and other financial help you might be eligible for.

Use the Turn2us benefits calculator.

When and how do I apply for Universal Credit (UC)?

UC is the primary financial help you receive so you should apply straight away. Go to: www.gov.uk/universal-credit/how-to-claim

If you don't have a bank account:

If a claimant does not have a bank account at the time they are making a new claim to Universal Credit, the following steps must be followed: during the new claim add 6 zeros (000000) for the sort code add 8 zeros (00000000) for the bank account number this will need to be done 4 times to progress the claim. If there is no option to say they don't have a bank account they will have to follow the above steps

See also Citizens Advice Bureau - What is Universal Credit

Can I get a Universal Credit advance?

As long as they have a live UC claim, as well as a National Insurance Number, job centre can issue a full new claim advance. Weybridge Jobcentre covers over 90% of Elmbridge postcodes (in terms of UC claims) – and covers the following: KT7, KT8, KT10, KT11, KT12, KT13, KT14 7, KT14 9, KT15, KT16, and KT22 0. Postcodes beginning KT6 would be covered by Kingston Job Centre.

When and how can I cancel or change a Universal Credit appointment?

You can change or cancel a Universal Credit appointment, following DWP guidelines, by signing into your Universal Credit Account or by phoning: 0800 169 0190

If you are on jobseeker’s allowance, you must prioritise your jobseeker’s activities, such as: attending interviews, job fairs, training courses, etc... If any of those activities are clashing with your UC signing in appointments with a coach, you can re-arrange your UC appointment as described above. Changing your UC appointment in advance, following DWP guidelines, provided you have a valid reason, will not affect your benefits.

Universal Credit frequently asked questions

What are the monthly standard allowances?

If you’re single and under 25: £265.31

If you’re single and 25 or over: £334.91

If you live with your partner and you’re both under 25: £416.45 (for you both)

If you live with your partner and either of you are 25 or over: £525.72 (for you both)

For your first child: £290.00 (born before 6 April 2017), £244.58 (born on or after 6 April 2017)

For your second child and any other eligible children: £244.58 per child

How Your Earnings and Hours Affect Your Payments?

Your Universal Credit payment will reduce as you earn more. For every £1 you or your partner earns your payment goes down by 55p. There are different rules if you’re self-employed. There’s no limit to how many hours you can work. Most employers will report your earnings for you.

You can earn a certain amount before your Universal Credit is reduced if you or your partner are either responsible for a child or are living with a disability or health condition that affects your ability to work. This is called a ‘work allowance’.

Monthly work allowance

You get help with housing costs: £344

You do not get help with housing costs: £573

Housing allowance see housing page

Housing Assistance

Reporting Change of Address and Housing Costs?

Report changes through your universal credit account. This is on the Home tab then Change of circumstances then Where you live and what it costs. The DWP will then send you a to-do asking for proof of the tenancy and proof of address. The most you can receive is the local housing allowance (LHA) rate for your household. This can be found at lha-direct.voa.gov.uk. Once you start paying rent a housing element will be included in your universal credit and will be paid monthly in arrears. Universal credit payment dates will not change.

Rent

• Discretionary housing payments can be available from Elmbridge Borough Council to provide financial help with rent or housing costs. You can claim if:

- you pay rent

- you already get Housing Benefits or the housing element of Universal Credit

- you are struggling to pay your rent even with Housing Benefit and Universal Credit

The payments are short-term to help pay rent and give you time to improve your circumstances. They can be awarded as a one-off payment or a series of payments.

Applications can be made online via this link: Discretionary Housing Payment (DHP) | Elmbridge Borough Council

• The Surrey Crisis Fund is a discretionary fund run by Surrey County Council. It provides financial help to Surrey residents who have nowhere else to turn in an emergency or following a disaster. It also can provide assistance to set up a home in the community where no other funds or resources are available. Applications can be made online or via your local Citizens Advice Bureau Surrey Crisis Fund - Surrey County Council (surreycc.gov.uk)

Council Tax

Elmbridge Borough Council will consider offering a reduction in council tax or alternative payment plan to those receiving Universal credit. Eligibility can be found their website. Discounts are also offered to those with diagnosed mental health conditions, disabilities and also to full time students.

Council Tax Support | Elmbridge Borough Council

Help with Energy and other costs

Sometimes you can claim extra money for particularly cold weather, or get help with insulating your house to keep it warmer, or your electricity company will discount you if you are on certain benefits..

More info here - Government Cost Of Living Support

Utilities

Most utility companies offer ‘social tariffs’ specifically for those in low-income groups. These normally must be applied for online.

Water:

• Apply for the low income fixed tariff - Affinity Water

• Financial support | Account and billing | Help | Thames Water

• Help paying your water bill | South East Water

Energy – Gas & Electricity:

- Warmth Matters - Surrey Community Action (surreyca.org.uk)

- Info – Energy Manage

- Octo Assist: Bill grants and help schemes | Octopus Energy

- Help with energy bills - Look After My Bills

- Independent fuel debt advice – British Gas Energy Trust

- Grants Available - British Gas Energy Trust

- How to apply to the EDF Customer Support Fund (edfenergy.com)

- EON Energy Fund -E.ON Energy Fund

- Customer Support Package (ovoenergy.com)

- ScottishPower Hardship Fund

- Here to Help (shellenergy.co.uk)

- Charis Let's Talk Energy Fund | Charis (charisgrants.com)

Communications

• Broadband and phone tariffs - Social tariffs are cheaper broadband and phone packages for people claiming Universal Credit, Pension Credit and some other benefits. Some providers call them ‘essential’ or ‘basic’ broadband.

Social tariffs: Cheaper broadband and phone packages - Ofcom

Cost of Living Payments

Households on certain means-tested benefits will get £900 in 2023/24 – the final instalment will be paid in February 2024. It'll be paid in three instalments, with the first two already paid: £301 – paid between 25 April and 17 May; £300 – paid between 31 October and 19 November 2023; £299 – to be paid between 6 and 22 February 2024.

To qualify for the final payment, you needed to be claiming one of the following benefits (or later found to be entitled to the benefit) between 13 November and 12 December 2023 (for Universal Credit, you need to have an assessment period that ended between those dates)

- Child Tax Credit

- Income-based jobseeker's allowance

- Income-related employment and support allowance

- Income Support

- Universal Credit

- Working Tax Credit

- Pension Credit (see below)

If you didn't receive the first or second payment, but think you're entitled, the Government has launched a webpage to report a missing payment.

Children / Childcare

Childcare costs

You can claim back up to 85% of your childcare costs if you’re working. If you live with your partner both of you need to be working, unless one of you is unable to work due to a disability or health condition. The childcare needs to be from an Ofsted registered provider. You can get help paying for childcare including nurseries, childminders, breakfast clubs, after school care and holiday clubs.

The most you can get each month is:

• £646.35 for one child

• £1108.04 for 2 or more children

You need to pay your childcare costs up front and claim the money back as part of your payment. You can get support to help you pay your childcare costs up front. Talk to your work coach after you’ve made your claim.

Finding Childcare and funded hours.

You can find out about your options of funded childcare at www.childcarechoices.gov.uk/

The easiest place to find registered childcare is at familyinformationdirectory.surreycc.gov.uk/ then click on the Childcare finder or at www.childcare.co.uk

• Free School Meals – all pupils in Reception, Years 1 & 2 in state funded schools are entitled

to free school meals. From Year 3, pupils may be entitled to free school meals if their parents receive qualifying benefits. Contact the school to make an application.

• Tax-free childcare - The Government offer up to £2,000 a year of tax-free childcare to help lower costs. Visit Get tax free childcare (GOV.UK) to see if you are eligible.

▪ School uniforms – If you are struggling to pay for school uniforms, here are a number of suggestions to reduce this cost:

- Ask your child's school if they provide discretionary grants for school uniform.

- Many schools hold second-hand stock for sale, exchange or donation.

- You can buy many of the basic, non-branded items, such as shirts, trousers, skirts and shoes at low cost from supermarkets like Tesco and Asda.

The following charities and organisations below may be able to help with the cost of school uniforms:

- Stripey Stork - offer new/good condition pre-loved children's clothes from birth up to age 16. Stripey Stork is not able to respond to requests from individual families, but you can request a referral from a family support worker, a social worker or through Elmbridge CAN.

- The Bridge — Walton Charity working in the heart of the local community

• Funded early education for Two-year-olds (FEET) can start at the beginning of the next Department of Education period following their second birthday. Children are entitled to a maximum of 570 hours per year. These will usually be offered as 15 hours each week for 38 weeks a year. Children are eligible, if your family receives Universal Credit, and your household income is £15,400 a year or less after tax, not including benefit payments OR Income Support, Income-based Jobseeker's Allowance (JSA) and Employment and Support Allowance (ESA). You can apply online through the funded childcare parent portal or email [email protected] for a paper application form.

• Funded early education and childcare for 3 and 4 year olds - all three and four-year-olds are entitled to up to 15 hours of funded early education and childcare a week for up to 38 weeks a year. This is to give children the opportunity to take part in planned learning activities and help prepare them for school through the early learning goals set out in the Early Years Foundation Stage. This is a universal offer and is available to all children regardless of their family circumstances.

• You can get 30 hours free childcare at the same time as claiming Universal Credit, tax credits, childcare vouchers, or Tax-Free Childcare. The funded hours will be made available to families where both parents (or the sole parent in a lone parent family):

- are working and earn on average a weekly minimum amount equivalent to working 16 hours at either National Minimum Wage (NMW) or National Living Wage (NLW)

- have an income of less than £100,000 each per year

- live in England (parents who are non-EEA nationals must have recourse to public funds to qualify)

Housekeeping (Food, Toiletries, Nappies, Clothing, etc):

• The Bridge The Bridge — Walton Charity working in the heart of the local community - Located in Walton, The Bridge is a community hub supporting families across Elmbridge who are struggling with the rising cost of living. It’s open on Tuesdays, Wednesdays and Thursdays for families who have been referred. Please speak to your child’s school, your GP or Elmbridge CAN for a referral. They offer a shop-without-a-till where families can pick-up fresh, frozen and cupboard food and household supplies at no cost, freeing up money for other family essentials like utility bills and school uniform. Families can also access specialist support and advice from Citizens Advice, Elmbridge Family Centre, Surrey Lifelong Learning and other local organisations. Regular wellbeing activities, like yoga, are available too.

• Elmbridge Eco Hub - Based in Walton, the hub provides access to a multi functional, safe space where they can reduce waste and access many beneficial initiatives such as the Library of Things, Community Fridge, Refill Shop, Skill Share, Repair Cafe, Small item recycling, Community Garden, Seed Bank, Jigsaw swap, Book Swap. No referral is needed.

Remember to take shopping bags if visiting to collect free food from the community fridge.

• Foodbanks How to get help | East Elmbridge Foodbank Walton & Hersham Foodbank | Helping Local People in Crisis Before you come along to a food bank centre to get food, you need a voucher. Vouchers can issued from the citizens advice bureau’s, schools, local charities.

• Elmbridge CAN Home (elmbridgecan.org.uk) aim to support families settle within our community. We can offer referrals and support in accessing local support services such as food banks; help source furniture for new homes; offer small emergency grants.

TV Licence

Do you need one? A TV Licence covers you to:

- watch or record TV on any channel via any TV service (e.g. Sky, Virgin, Freeview, Freesat)

- watch live on streaming services (e.g. ITVX, Channel 4, YouTube, Amazon Prime Video, Now, Sky Go)

- use BBC iPlayer*.

- streaming services like Netflix and Disney Plus

- on-demand TV through services like All 4 and Amazon Prime Video

- videos on websites like YouTube

- videos or DVDs

Debt Support / Advice

- CAP (Christians Against Poverty) Home | CAP UK – Offer free help locally on getting out of debt, budgeting, making your money go further, life skills or even help finding a job.

- Citizens Advice Bureau (CAB) – Citizens Advice Advice is offered for many areas, including accessing benefits and foodbanks, dealing with debt and rent arrears, legal matters and much more. Elmbridge CAB locations:

o CAB Esher & District, Harry Fletcher House, High Street, Esher KT10 9SD · Tel: 01372 464770 Website: eshercab.org.uk

- StepChange Charity What is Breathing Space and How to Apply. StepChange. Breathing Space is a government scheme that gives you a break from interest, fees, and court action for up to 60 days.

Please Note: If you are struggling to pay your bills, it is always best to contact your provider straight away and explain. They may be able to put you on one of the reduced payment plan or social tariffs mentioned above. Never ignore bills, this can lead to penalty payments and increased debt.

For up to date information on the best deals for utilities, credit cards, broadband, mobile phone tariffs and more, take a look at: Money Saving Expert: Energy Help, Credit Cards, Flight Delays, Shopping and more

Can I get help with my NHS health costs if I'm a refugee or Asylum Seeker? If you receive Asylum Support from UKVI (UK Visas and Immigration), you’re entitled to a HC2 certificate, free NHS prescriptions, free NHS dental treatment, free NHS sight tests, help towards the cost of glasses or contact lenses, free NHS wigs and fabric supports, help towards travel costs to receive NHS treatment Read more

If you are in receipt of universal credit and your take-home pay per month is up to £435 or up to £935 if you are responsible for a child or have limited capability for work. You are likely to be asked to show your last month payment statement. Further information is available at: www.nhs.uk/nhs-services/help-with-health-costs/

ENIC – Statement of Comparability

ENIC is a service available if you need to evidence the level of your overseas qualification for employment, study, professional registration, or another reason. There website is https://www.enic.org.uk/Qualifications. If you need this is support for application for employment, please discuss this with your work coach.

Flexible Support Fund

Your work coach has funding to support you in removing barrier to finding or start work – this could be internet access, travel cost to interviews or to start work, appropriate clothing, upfront childcare cost. If there is a Barrier to you starting work, please discuss this with your Work Coach.

Benefit Calculator – Entitled to

This will give you an estimate of the benefits you could get and how your benefits will be affected if you start work or increase your hours. The website is: www.entitledto.co.uk/benefits-calculator

When and how should I apply for Pension Credits

Go to Pension Credit: Overview - GOV.UK (www.gov.uk)

Food Support

|

Fresh food from supermarkets and cafes very cheap

Download the GoodToGo app, put in your postcode, and get notifications when local cafes and supermarkets have food close to expiry in a Suprise Bag. Save money and save the environment from waste as well ! |

|

Community Fridges

Elmbridge ECO Hub in Walton-on-Thames KT12 1LH take surplus food from supermarkets that would otherwise go to waste and offer it free or pay as you can afford. They are not foodbanks, and the food is available for all. |

Other community Fridges:

Lower Green Community Centre - Esher - https://www.lowergreen.org/

Hebrews Coffee Shop - Addlestone - Community Fridge and pay-as-you-feel cafe - https://www.stpaulscofe.org/hebrewscoffeeshop.htm

Surplus to Supper - Sunbury - Weekend pay-as-you-feel Surplus Shop - https://www.surplustosupper.org/

Foodbanks

Depending on your circumstances, we can help you access the Foodbanks that require voucher. Please get in touch with us and we can talk through your needs and budget.

Lower Green Community Centre - Esher - https://www.lowergreen.org/

Hebrews Coffee Shop - Addlestone - Community Fridge and pay-as-you-feel cafe - https://www.stpaulscofe.org/hebrewscoffeeshop.htm

Surplus to Supper - Sunbury - Weekend pay-as-you-feel Surplus Shop - https://www.surplustosupper.org/

Foodbanks

Depending on your circumstances, we can help you access the Foodbanks that require voucher. Please get in touch with us and we can talk through your needs and budget.

How can I pay for emergency needs?

In certain circumstances Elmbridge CAN can give small grants to cover emergency needs that cannot be met in other ways. If you are in this situation please let us know through one of our staff or volunteers, or you can email us at [email protected].

DONATIONS to help us provide emergency grants are always welcome and can be made through our donate page.

DONATIONS to help us provide emergency grants are always welcome and can be made through our donate page.

How do I find affordable internet?

There are a range of internet providers offering social tariffs (more affordable broadband deals).

These are all available to people in receipt of Universal Credit. Some have broader criteria as well meaning you may be eligible for other reasons. Click here to go to the Ofcom webpage comparing the social tariffs.

These are all available to people in receipt of Universal Credit. Some have broader criteria as well meaning you may be eligible for other reasons. Click here to go to the Ofcom webpage comparing the social tariffs.